.jpg)

February 24, 2020

EV Adoption: How ICE Vehicle Industry Disruption from Within Might Move the Needle

Automotive World recently published this interesting piece – An ICE-y road to an electric future – on why internal combustion engine (ICE) cars will still be around in large part for the next few decades to come. This article talks about the emission standards squeeze on ICE cars, and EVs facing battery cost issues, and thus the balance might not tip in favor of EVs for many years. This offers encouragement for the ICE car industry, and likely the scenario that could play out.

Most disruptions are slow, with small cuts and chips on the edges of an established industry finally causing disruption from within. Let’s look at how some of these second-and third-order effects could impact ICE.

1. Rising Environmental Regulation Costs

Environmental regulations are tightening in many parts of the world, putting pressure on ICE vehicles to be ever more efficient. These battles increase advertising and lobbying costs of ICE vehicles, which are passed along to the consumer, thus making these vehicles more expensive to own.

2. Drop in Market Share

There’s a domino effect on the industry value chain when an industry begins to lose market share. For example, just a 5% drop in market share for ICE vehicles could cause:

- Shrinking ICE car dealership footprints

- Shrinking mom and pop repair shops, either being bought by chains OR just going out of business

- Shrinking parts supplies

- Pressure on road infrastructure

These factors could make repairs for ICE cars expensive. Even if these factors only add 5% to the total cost of ownership of ICE cars, EVs could become more attractive to the general population.

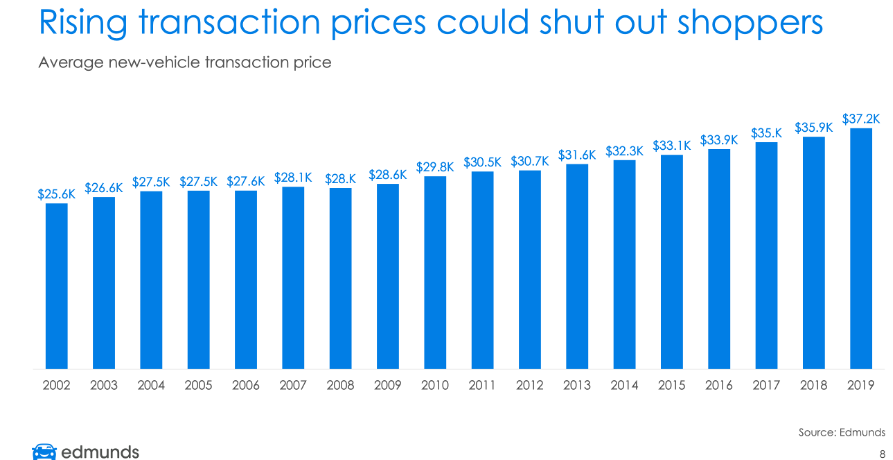

3. Rising Vehicle Prices

The average sale price of an ICE car has been rising and is expected to reach $38,000 this year, due to factors like higher demand for SUVs, increasingly sophisticated technology in the cars and luxury/comfort features.This rising cost is in fact making EVs more competitive on price.

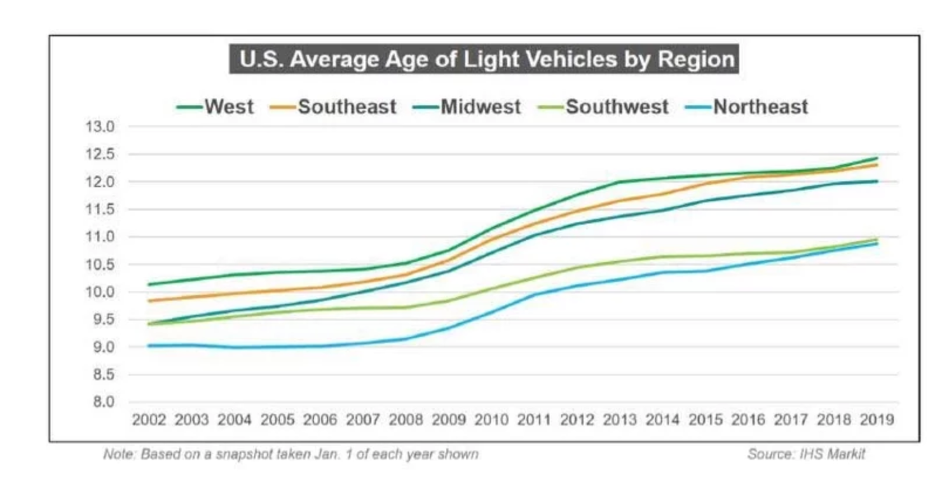

4. More Older Cars on the Road

The higher pricing trends are also forcing people to keep their cars much longer. Cars are lasting longer too. More older cars on the road could have a positive impact on the revenue of repair shops.

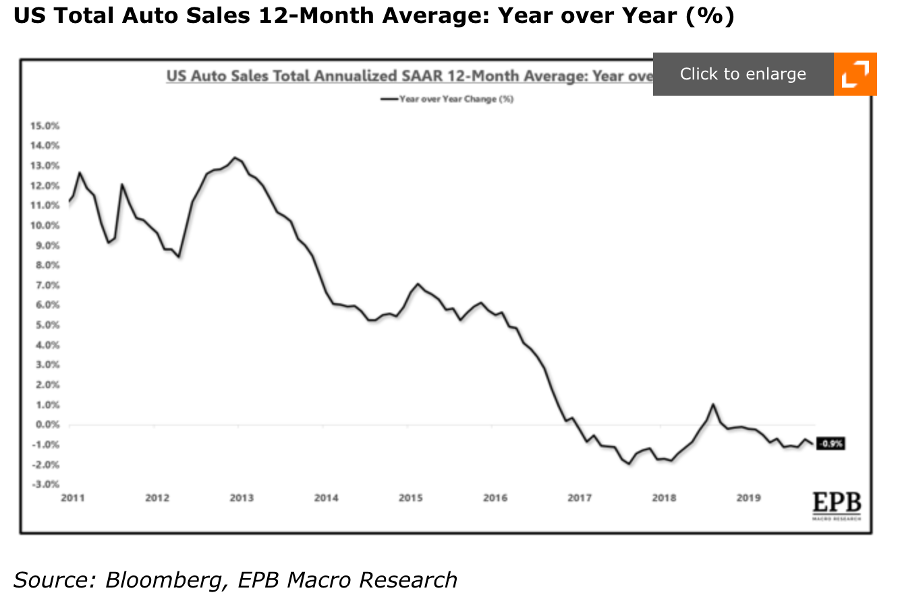

5. Declining New Vehicle Sales

A decline in auto sales for nearly three years is putting pressure on many OEMs’ bottom lines. There are already signs of many OEMs announcing cost reduction initiatives. Most of these reductions are in ICE vehicle production.

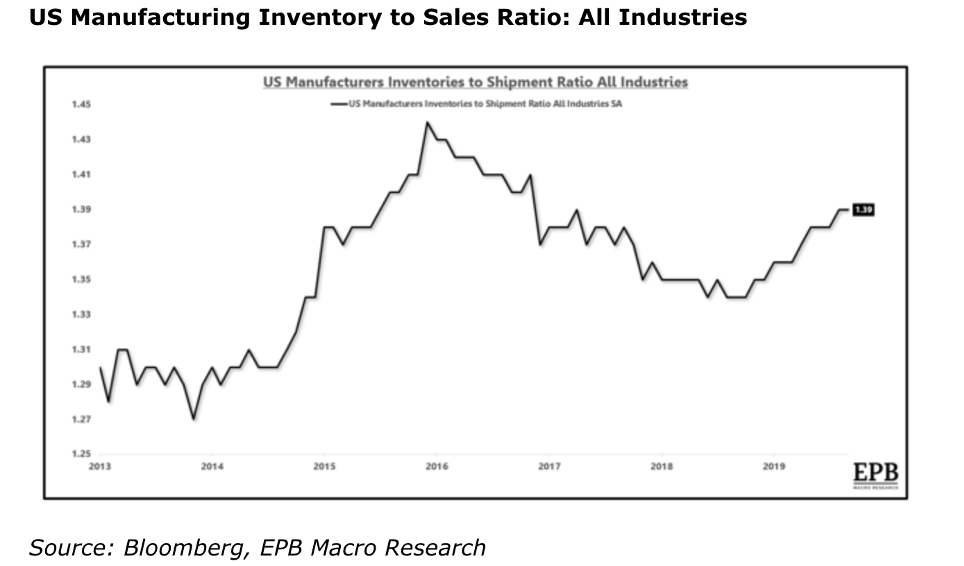

6. Rising Inventory

Rising inventory ratios could force dealerships and OEMs to cut prices, thus hitting their bottom lines. This is not good for ICE or for EVs. Lower profits could mean less money for EV development initiatives, thus delaying the adoption. However, one winner could be TESLA, since it doesn’t have older ICE infrastructure to worry about, much like China had no credit card industry to worry about when moving to mobile payments.

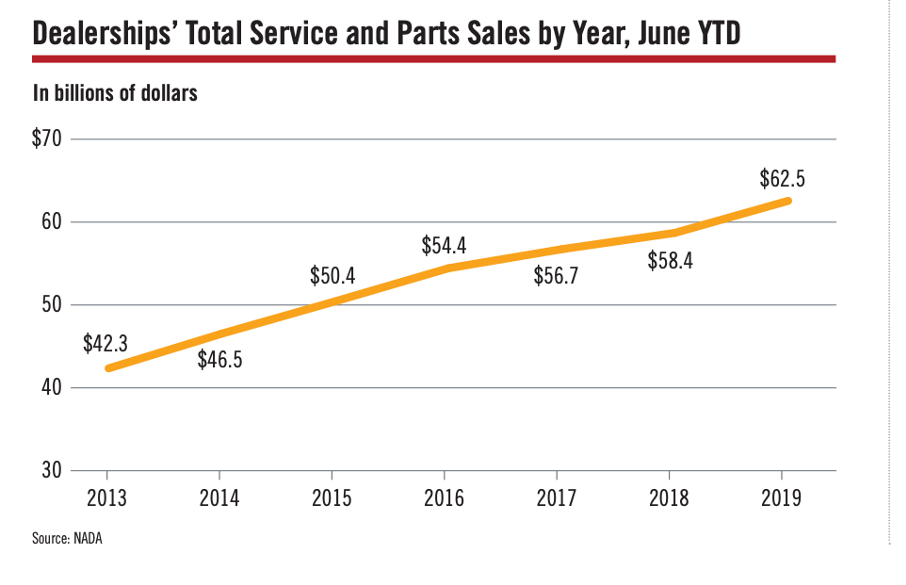

7. Rising Repair Costs

There were roughly 276 million vehicles on road in 2019, supported by 160,000 independent repair shops, representing $115 billion in revenue. A 5% drop in ICE vehicles would cause a nearly $5 billion drop in revenue (unless vehicle repair costs shoot up more), and could impact nearly 8,000shops.

At the same time, OEMs are aggressively working to move repair business back to their dealers, in an effort to establish better relationships with end customers, which also puts pressure on independents.

Higher repair costs and higher new car prices incentivize subscription models to work, which puts the control of the vehicle ONLY withOEMs, and thus with dealerships. So, the dealerships should see even better service businesses in future, and driving out more independents, which, in long run, will make repairs even more expensive.

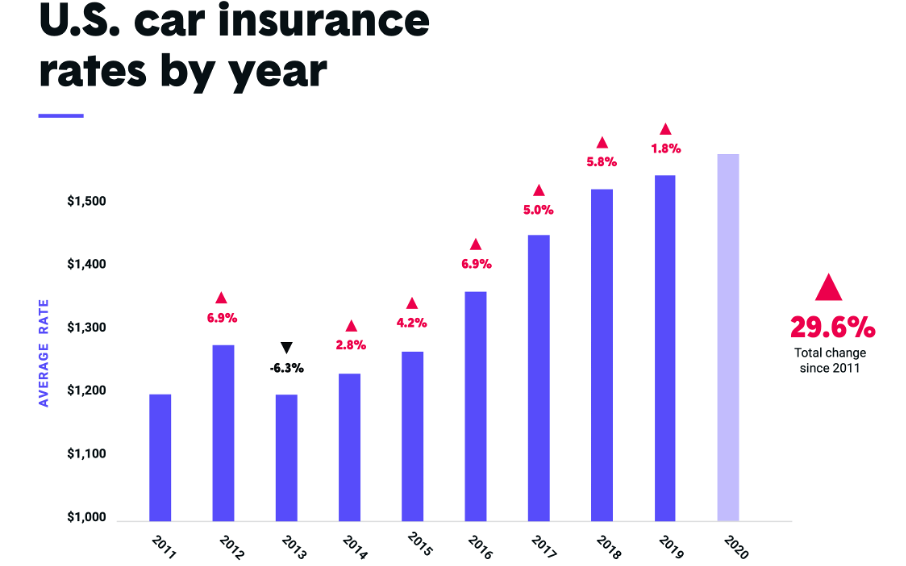

8. Rising Insurance Prices

Insurance rates have also been going up year over year, simply because cars are expensive to fix. Technology in cars is still not cutting collision rates it seems. Higher insurance costs are also likely to deter people from buying newer cars, thus putting pressure on OEMs, and perhaps helping the ICE cause versus EVs.

In essence, these second- and third-order factors will shape the viability of EVs and ICE vehicles. It will not be an easy win for either category. What we can count on is more disruption in the years ahead. It will be fascinating to watch how the whole ecosystem readjusts over the next few decades.